Pros and Cons of buying your first property after 50

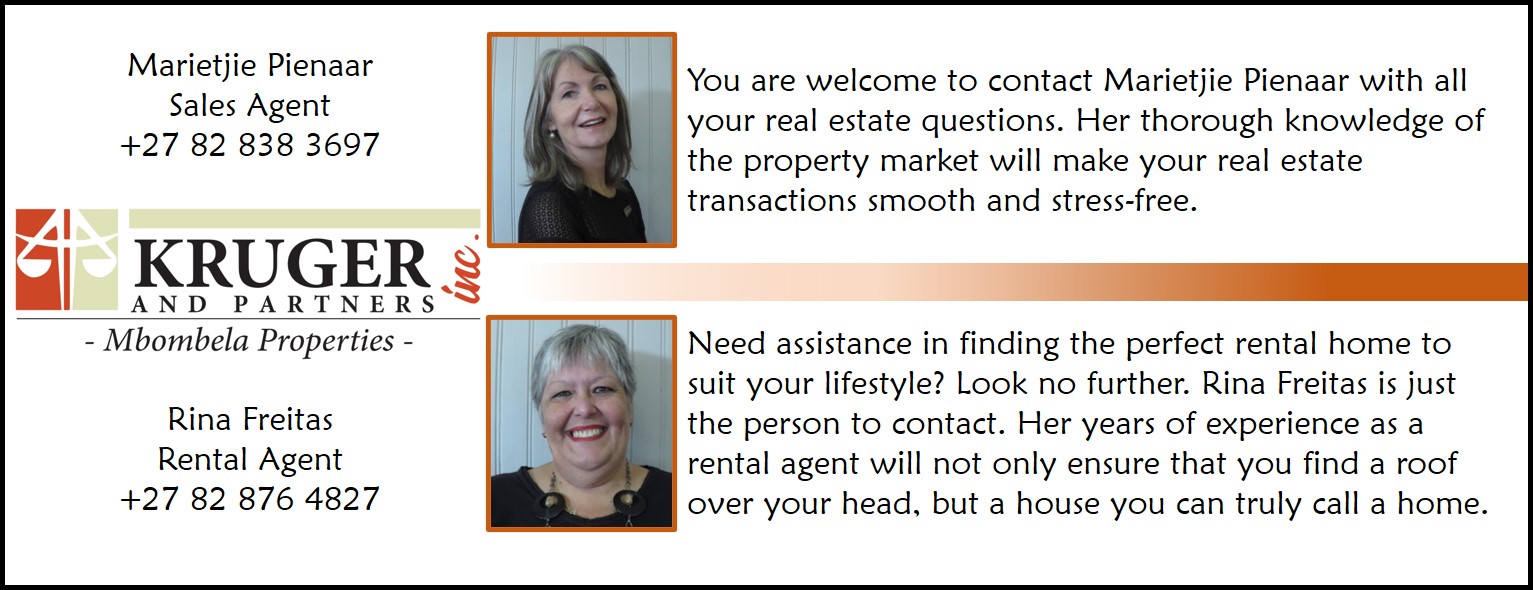

Follow us on Facebook or visit one of our websites: Kruger and Partners Inc. / Mbombela Properties.

Buy or rent - which is best

Buying an own house remains a dream for many and comes with many benefits, but also with cons and responsibilities, especially if you are older than 50.

Buying your first property later in life is not impossible but needs to be considered carefully. Older people can get a bond to purchase their first home and share in these benefits, despite a reduced loan term and increased monthly instalment.

Owning gives stability but renting offers flexibility. The latter can be less expensive because you don't have to pay for maintenance and repairs but owning can be less stressful if you don't have to worry about a landlord raising the rent.

The benefits of owning a home

- Stable monthly payments

- If you obtain a mortgage, it is likely to get a fixed rate mortgage, resulting in stable monthly payments.

An opportunity to build equity

Property ownership is a good opportunity to build equity, which is the probable market value of a home minus any liens against the property, such as a mortgage. The longer you own a property, the more you will pay towards the principle balance of a mortgage and hopefully the value of the property increases, which enlarges the equity.

You have the freedom to make changes

One of the biggest benefits of owning the property you live in, is the ability to make changes according to your lifestyle. When renting, it may be impossible to make even the simplest change as it is often prohibited by your lease. Not only is alterations a great way to make a house a home, it can increase the property’s value or allow you to adapt according to your physical abilities.

A property is a solid investment

Owning a home is a solid investment and may provide a better return on investment since real estate usually appreciates, depending on market conditions.

Cons of buying a house after 50

- You are responsible for maintenance costs and repairs

- A property owner is responsible for all home repair, maintenance, and renovation costs, which can get quite pricey

- Less flexibility as to where to live and downsizing may be difficult

- Renters can practically live anywhere, while as a homeowner you are restricted to areas where you can afford to buy. A renter has the option to downsize to a more affordable living space at the end of a lease, which is important for retirees who need a less costly, smaller alternative to match their budget.

Conclusion

With retirement and having to live on a fixed income, looming for over 50s, they should aim to enter retirement with as little debt as possible. If you first buy a home at age 50 and take out a 30-year loan, you will have to pay it off well into retirement at great financial strain. If however, you can buy a home at age 50 with only a 15-year loan on it, you can have it paid off by age 65, which is a financially secure way to begin retirement.

Editor: Anchen Coetzee

Written by: Mariana Balt