Become the master of your future - top five tips for smart saving

Saving can be tough, especially when you experience the month-end phenomenon of too much month at the end of your money. “However,” says Alfred Ramosedi, African Bank Group Executive: Sales and Marketing, “when we think about the future and all we wish to attain or achieve, it is important to remember that saving money now can have a direct impact on how quickly we are able to achieve our goals.”

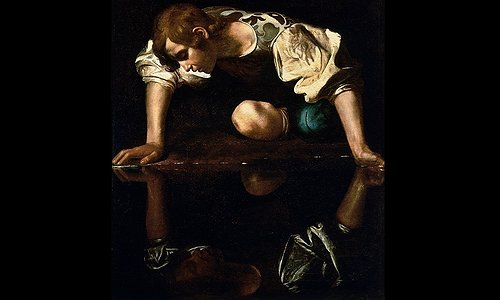

Alfred Ramosedi.

Alfred Ramosedi.

While setting a portion of our salary aside may seem impossible when we think of our monthly financial responsibilities, it is important to take note of the fact that sacrificing a few luxuries now will yield fruitful benefits in the future.

Instead of thinking about saving our pennies, we think of luxurious holidays, festive weddings, or the glow of welcoming a new family member into the world. “While there’s nothing wrong with dreaming big, we shouldn’t lose sight of the importance of healthy and sustainable savings,” says Ramosedi.

He offers these top five tips to help you become the master of your future:

• Understand what you’re working with

When it comes to your finances, it is important to take note of what you’re working with. Do you have one salary, are you combining two salaries from two people, what are the monthly responsibilities from which you can’t break away? If you’re looking to formulate a budget, take your net salary (after tax) and subtract your monthly debit orders and payments - these could be the monthly instalments on your credit card, personal loans, or cell phone bills. Once you have subtracted these amounts, take a look at your responsibilities and dedicate an estimate of what you need to spend on each responsibility per month. Subtract the responsibilities, and your possible savings lie in what is left over. Keep in mind the fact that saving 10% of your net salary is an ideal starting point.

• Live like you’re earning less

If you decide to set 10% of your earnings aside every month for the purpose of saving, it is important to remember that you will need to live like you’re earning 10% less to ensure that you don’t dip into your savings. While it might require some sacrifice, living a more frugal lifestyle now will ensure that you are able to have better sustainable financial freedom in the future.

• Practice the art of saying ‘No’

While a new suit, handbag or car may seem like a good idea now, it is important to remember that you may have to spend months or years paying it off, which can have an effect on your cumulative savings. To ensure that you are able to save money, you will need to ensure that you practice the art of saying ‘no’ when temptation calls your name.

• Stick to your goals

Do you dream of buying your own home, pursuing your studies or starting a family? Perhaps you need to save up for a deposit on a loan for a new car or would like to pay off your debt? If you’re looking for motivation to save your pennies, it is important to decide on a financial goal and stick to it. Not only will this ensure that you find the motivation to save your money, but it will also ensure that you stick to your goals to achieve a quicker result.

• Plan for impulsive spending

While saving is imperative to ensure a more stable financial future, it is also important to take note of the fact that impulsive spending does happen – whether it’s on a new pair of shoes, a holiday or a lavish dinner. Taking ownership of the fact that spontaneous spending does happen will ensure that you set aside a small sum of money, allowing you wiggle room in which to enjoy life as it happens.

“Saving isn’t always easy so make sure you speak to a financial advisor if you are struggling. They may be able to identify areas where you can cut back so you can get saving smart,” concludes Ramosedi.

Submitted by: Jacqui Rorke / Cathy Findley PR.

Main Image URL